Online payroll software is a tool that allows businesses to process and manage their payroll operations entirely online. These systems can handle tasks such as calculating employee pay and taxes, preparing and distributing paychecks or direct deposits, and tracking employee time and attendance. They often also provide features for handling other HR-related tasks, such as benefits administration and compliance management.

One of the main benefits of using online payroll software is that it automates many of the manual processes involved in payroll, which can save a significant amount of time and reduce the risk of errors. Additionally, because the data is stored in the cloud, the software is typically accessible from anywhere with an internet connection, and it can be used by multiple employees within an organization. Many solutions also offer mobile apps for managers and employees to access.

Online payroll software can be sold as a standalone product or as part of a larger suite of HR software, and it is available in a variety of price ranges to suit businesses of different sizes and industries. Some providers also offer different pricing plans based on the number of employees, which makes it easy for small businesses to get started with the software at a low cost.

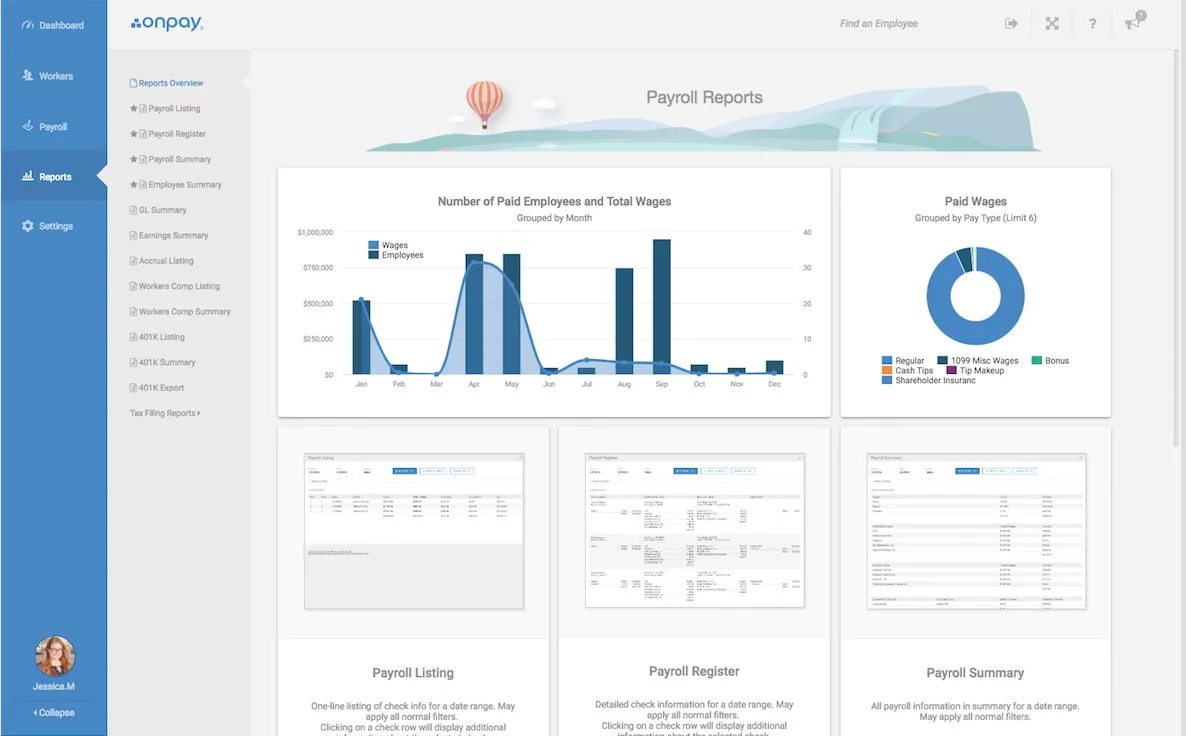

#1. OnPay

OnPay is an online payroll software that is designed to help small businesses process and manage their payroll operations. The software is built to be easy to use and has a user-friendly interface, which enables business owners and managers to handle payroll tasks quickly and efficiently.

OnPay includes a wide range of features to manage payroll such as calculating pay, taxes, and deductions; generating paychecks or direct deposit payments; and tracking employee time and attendance. The software also allows businesses to manage employee records, such as personal and contact information, and to access detailed payroll reports. Additionally, it also offers various additional features like integration with other HR software, an Employee self-service portal, and a mobile app for managers and employees.

One of the benefits of OnPay is its automation of many payroll-related tasks which helps to reduce the risk of errors, and also saves business owners time. The software is also compliant with various regulations and taxes, which eliminates much of the headache associated with keeping up with tax laws and compliance.

OnPay is also designed to be scalable for small businesses which means that their pricing model is based on the number of employees. It does not charge extra for additional features and offers flat-rate pricing, which helps small businesses to manage costs.

#2. Gusto

Gusto is an online payroll software and benefits platform designed for small and medium-sized businesses. It is designed to help businesses automate their payroll and HR processes, and simplify compliance with various tax regulations.

Gusto offers a wide range of features that can help businesses with their payroll and HR needs, including calculating pay, taxes, and deductions; preparing and distributing paychecks or direct deposit payments; tracking employee time and attendance; and managing employee records. The software also includes benefits administration features, such as enrolling employees in benefits plans and tracking employee contributions.

One of the key features of Gusto is its comprehensive compliance support, which covers various regulations such as State and Federal taxes, and also supports compliance with various labor laws. This can help businesses stay compliant and avoid penalties, which saves time and money.

Gusto also provides an employee self-service portal, where employees can access their pay stubs, W2s, and other important HR-related documents. Additionally, it also offers a mobile app for managers and employees to access their data from anywhere.

Gusto is also designed to be scalable, with pricing that is based on the number of employees and can be bundled with additional services, such as health benefits, 401K plans, workers’ compensation insurance, and more.

#3. Rippling

Rippling is an all-in-one software that helps small and medium-sized businesses manage and automate various aspects of their operations. This includes HR, payroll, benefits, IT, security, and compliance.

One of the key features of Rippling is its ability to automate and streamline HR processes, such as onboarding, offboarding, and employee management. It also includes payroll capabilities, allowing businesses to calculate pay, taxes, and deductions, prepare and distribute paychecks or direct deposit payments, and track employee time and attendance.

Rippling also offers a range of benefits administration tools, which can help businesses enroll employees in benefits plans, track employee contributions and ensure compliance with regulations. Additionally, it also provides an employee self-service portal where employees can access their pay stubs, W2s, and other important HR-related documents.

Another important feature of Rippling is that it can integrate with various other systems such as Single sign-on, IT management, and security tools, which can help businesses improve the efficiency of their operations and better manage their IT environment.

Rippling also offers a mobile app for employees and managers to access the system from anywhere. It also has transparent and flexible pricing, with plans that can be tailored to the specific needs of a business, as per the number of employees.

#4. Intuit QuickBooks Payroll

Intuit QuickBooks Payroll is a payroll management software that is integrated with the QuickBooks accounting software. It is designed to help small and medium-sized businesses process and manage their payroll operations. The software automates many of the manual processes involved in payroll, which can save businesses a significant amount of time and reduce the risk of errors.

QuickBooks Payroll includes features such as calculating pay, taxes and deductions; preparing and distributing paychecks or direct deposit payments; and tracking employee time and attendance. It also allows businesses to manage employee records, such as personal and contact information, and to access detailed payroll reports. The software also supports compliance with various regulations and taxes, which can help businesses stay compliant and avoid penalties.

One of the benefits of using Intuit QuickBooks Payroll is that it is integrated with QuickBooks accounting software, which allows businesses to manage their finances and payroll in one place. This integration enables businesses to easily track and reconcile payroll expenses, generate accurate financial reports, and to better manage their cash flow.

QuickBooks Payroll is designed to be scalable and can be used by businesses of different sizes and industries. The software also provides a mobile app for managers and employees to access their data from anywhere. Additionally, it also has different pricing plans based on the number of employees, which makes it easy for small businesses to get started with the software at a low cost.

#5. SurePayroll

SurePayroll is an online payroll software designed for small businesses. The software is designed to automate and simplify the process of payroll, taxes, and compliance, helping businesses save time and reduce the risk of errors.

SurePayroll provides a wide range of payroll capabilities, including calculating pay, taxes, and deductions; generating paychecks or direct deposit payments; and tracking employee time and attendance. The software also allows businesses to manage employee records, such as personal and contact information, and access detailed payroll reports.

SurePayroll also includes a range of compliance features that help businesses stay current with various tax regulations, such as federal and state taxes, and labor laws. This can help businesses avoid penalties and fines, which can be a significant cost saving. The software also offers support for various forms like W-2 1099 and also prepares payroll tax forms.

The software offers a user-friendly interface, which allows business owners and managers to handle payroll tasks quickly and efficiently. It also provides an employee self-service portal where employees can access their pay stubs, W2s, and other HR-related documents.

SurePayroll is designed to be scalable and offers different pricing plans based on the number of employees, with additional services available at an additional cost. This makes it easy for small businesses to get started with the software at a low cost and to grow as the business expands.

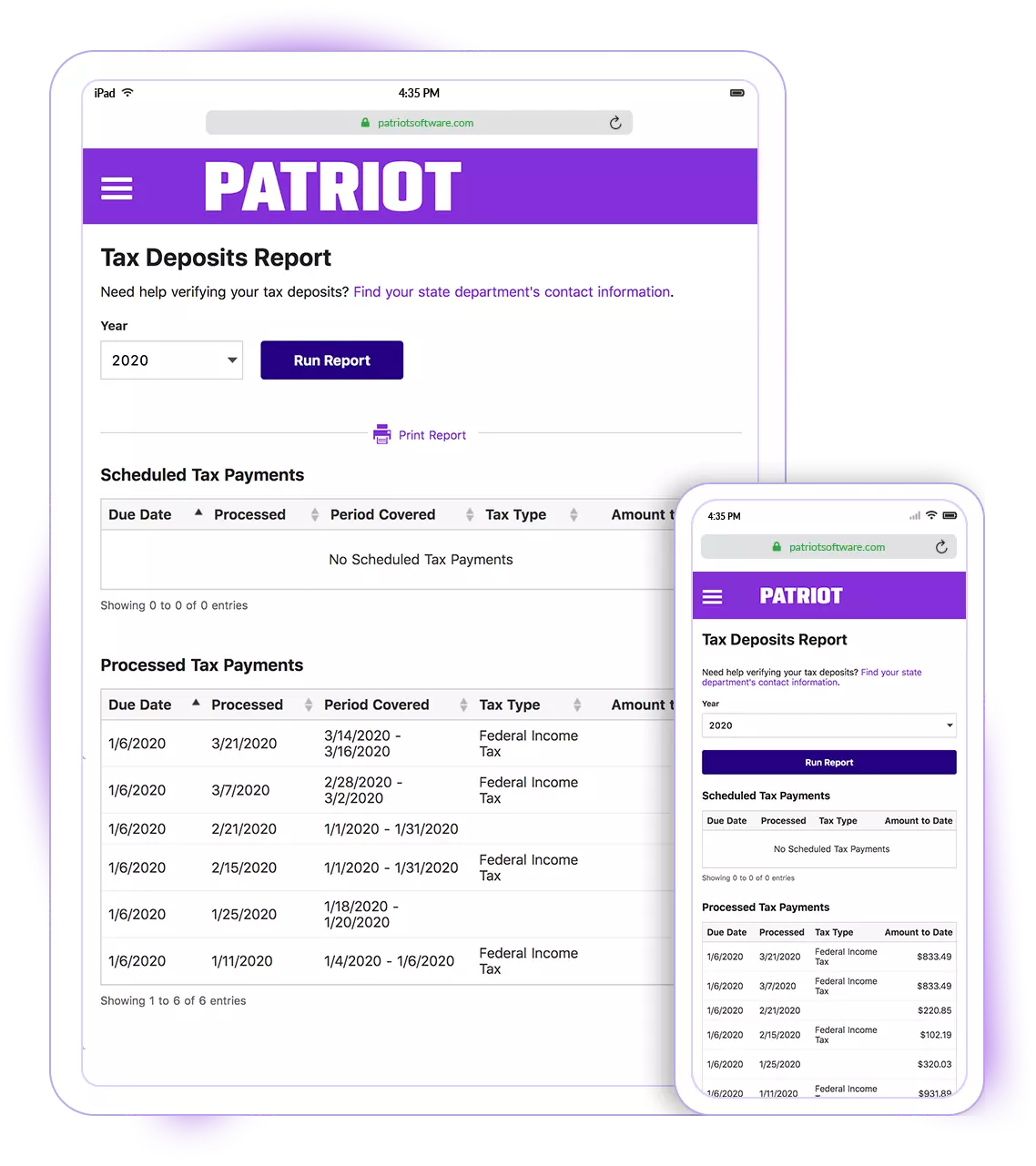

#6. Patriot Software Full Service Payroll

Patriot Software Full Service Payroll is a payroll management software designed for small and medium-sized businesses. The software provides a wide range of features to manage payroll, such as calculating pay, taxes, and deductions; generating paychecks or direct deposit payments; and tracking employee time and attendance.

One of the key features of Patriot Software Full Service Payroll is that it provides full-service payroll, which means that the software handles all aspects of payroll, taxes, and compliance. Businesses don’t have to worry about handling these tasks manually, which can save them time and reduce the risk of errors. Patriot software also offers compliance support with various labor laws.

The software also includes an employee self-service portal, where employees can access their pay stubs, W2s, and other HR-related documents. Additionally, it also offers a mobile app for managers and employees to access their data from anywhere.

One of the benefits of Patriot Software Full Service Payroll is its competitive pricing and flexibility, which is based on the number of employees, which makes it easy for small businesses to get started with the software at a low cost. They also offer a 30-day free trial period which allows businesses to test the software before making a purchase.

Patriot Software Full Service Payroll also offers additional services like 401k and worker’s compensation insurance, which can help businesses to manage all of their payroll and benefits needs in one place.

#7. Roll by ADP

Roll by ADP is an online payroll software designed to help small and medium-sized businesses process and manage their payroll operations. The software is designed to automate and simplify the process of payroll, taxes, and compliance, which can save businesses time and reduce the risk of errors.

Roll by ADP provides a wide range of features to manage payroll, such as calculating pay, taxes, and deductions; generating paychecks or direct deposit payments; and tracking employee time and attendance. The software also allows businesses to manage employee records, such as personal and contact information, and access detailed payroll reports.

The software also includes compliance support, covering federal and state taxes, labor laws, and other regulations. This can help businesses stay compliant and avoid penalties, which can be a significant cost saving. The software also offers support for various forms like W-2 1099, and also prepares payroll tax forms.

One of the benefits of Roll by ADP is the scalability of the software, as it can be used by businesses of different sizes and industries. The software also provides a mobile app for managers and employees to access their data from anywhere. Additionally, it also has different pricing plans based on the number of employees, which makes it easy for small businesses to get started with the software at a low cost.

Roll by ADP is developed and provided by ADP, which is a well-established and reputable provider of payroll and HR software solutions, so businesses can expect robust and reliable software with a good level of customer support.

#8. Square Payroll

Square Payroll is an online payroll software solution that is designed for small businesses. It is a part of the broader Square Suite of business tools and it aims to make payroll and compliance processes simpler for businesses. The software is designed to automate and simplify the process of payroll, taxes, and compliance, which can save businesses time and reduce the risk of errors.

Square Payroll provides a wide range of features to manage payroll, such as calculating pay, taxes, and deductions; generating paychecks or direct deposit payments; and tracking employee time and attendance. The software also allows businesses to manage employee records, such as personal and contact information, and access detailed payroll reports.

The software also includes compliance support, covering federal and state taxes, labor laws, and other regulations. This can help businesses stay compliant and avoid penalties, which can be a significant cost saving. The software also offers support for various forms like W-2 1099 and also prepares payroll tax forms.

One of the benefits of Square Payroll is that it’s integrated with other Square’s business tools, such as Point-of-Sale (POS) systems and inventory management. This allows businesses to manage all aspects of their operations in one place, which can make it easier for them to track and reconcile payroll expenses and manage their cash flow.

Square Payroll pricing is flexible, with plans that can be tailored to the specific needs of a business, as per the number of employees. The software is user-friendly, with an intuitive interface, which makes it easy for business owners and managers to handle payroll tasks quickly and efficiently.

#9. Workful

Workful is an online payroll and HR software designed for small businesses. It aims to help businesses automate and simplify their payroll, HR, and compliance processes, saving them time and reducing the risk of errors.

Workful provides a wide range of features to manage payroll, such as calculating pay, taxes, and deductions; generating paychecks or direct deposit payments; and tracking employee time and attendance. The software also allows businesses to manage employee records, such as personal and contact information, and access detailed payroll reports.

The software also includes compliance support, covering federal and state taxes, labor laws, and other regulations. This can help businesses stay compliant and avoid penalties, which can be a significant cost saving. The software also offers support for various forms like W-2 1099, and also prepares payroll tax forms.

One of the benefits of Workful is that it integrates with other business tools, such as point-of-sale (POS) systems, inventory management, and time tracking. This allows businesses to manage all aspects of their operations in one place, which can make it easier for them to track and reconcile payroll expenses and manage their cash flow.

Workful’s pricing is based on the number of employees and offers a free trial so businesses can test the software before committing to a plan. The software is user-friendly and easy to navigate, with a simple interface, which makes it easy for business owners and managers to handle payroll tasks quickly and efficiently. Additionally, it also provides a mobile app for employees and managers to access the system from anywhere.

In terms of pricing, many online payroll software solutions are based on the number of employees and offer different pricing plans to suit businesses of different sizes. This allows small businesses to get started with the software at a low cost and allows for scalability as the business expands.

It’s important for businesses to consider their specific needs and research various options before choosing an online payroll software solution. It’s also essential to evaluate software based on compliance support and integration capabilities with other tools for a smoother experience.

Add Comment